There’s great comfort in knowing you can weather the most common “financial emergencies” like a new transmission for your car, a trip to the emergency room and even the dreaded AC unit replacement. It’s important to have an emergency fund in place, but what’s considered a viable amount and how long does it take to build? Can it be done in a year or less? The short answer is with some work, yes.

First Things, First

Before rolling back your sleeves and building an emergency fund, make sure you address any outstanding credit card balances first. Dave Ramsey suggests setting aside $1,000 into your savings first to give some breathing room, then paying off credit cards so you can start building your full emergency fund.

Another potential misstep would be calling your emergency fund a zero balance credit card or HELOC (Home Equity Line of Credit). Many folks use this approach because they don’t want their savings earning close to zero interest. I don’t recommend this for two reasons. First, the last thing you want to do (if faced with a financial emergency) is to add fuel to the fire by adding debt. Second, you shouldn’t be overly concerned with growth or how much interest you’re earning with money you may need to spend within 36 months. You just need to know the money will not lose value and be accessible.

Establish the Right Amount

The tried-and-true way to establish an emergency fund is having three to six months of spendable income in place. For example, if you are paid bi-weekly, take your direct deposit amount and multiply it by 6 (3 months) or 12 (6 months) and that’s the target number to have in your emergency fund. I recommend closer to 6 months for an added sense of security – better to have it and not need it than to need it and not have it.

Here are five practical ways to build your emergency fund within a year. They can be used individually or combined with each other to establish your emergency fund.

1. Set Up An Allotment from Your Paycheck

If you’re paid in a regular frequency (bi-weekly or monthly), this is a simple and effective way to reach your savings goal. For example, let’s say you want $9,000 in your emergency fund in one year. If you’re paid bi-weekly, you have 26 pay periods every year: $9,000 / 26 = $346 allotment every paycheck.

This strategy requires two disciplines. The first is to set up your emergency fund at a financial institution other than the one you have your primary checking account. This removes the temptation – out of sight, out of mind. The second is to not overdo it. This plan will backfire if you get too ambitious and set up an allotment for an amount that is not sustainable. If you can’t hit your twelve month goal, then adjust the timeframe or implement other strategies.

2. Sell Your Stuff

This one is pretty self-explanatory, but it’s also easier said than done. It’s a challenge to let go of stuff we never use – we get sentimental or rationalize unlikely scenarios where something may come in handy. A good rule of thumb is if you haven’t used it in the last year, you are not likely to use it again. Earn some extra cash and sell your stuff to someone who needs it more.

3. Reduce Retirement Account Contributions (401(k) / TSP / IRA 403(b) / 457)

This one tends to raise some eyebrows and cause controversy, but temporarily reducing your 401(k) or other retirement account contributions for the sake of building your emergency fund may be the right approach. Once the money enters into your retirement account, there could be penalties for accessing the funds should you get into a financial pinch. If you have a company match, you may want to consider contributing the minimum amount to receive the match. Prioritize the emergency fund first.

4. Tighten Up Your Budget

If you honestly track your spending for 30 days, you will likely find one or two spends that cause you to be a little upset with yourself. Commonly eating out is one of the usual suspects. Amazon is also a frequent offender. Look over what you’re spending and adjust accordingly – it’s that simple. I like to see what percentage each category of spending represents (insurance: 8%, eating out: 5%, mortgage: 25%, etc.). Give it a try, the results may surprise you.

5. Get a Side Job

I realize this strategy may not initially get you excited, but keep in mind this is a temporary means to an end. The good news is there are so many opportunities today to pick up a side job with flexible hours. Rideshare companies like Lyft and Uber are just one of many ways to generate some extra income with flexible hours. Get creative, and have fun with it.

When you hit your emergency fund goal, you can go back to your retirement account funding – ideally 15% or more. Don’t forget all the lessons learned from reviewing your budget and spending. Keep the unnecessary spending down. Should an emergency occur and you have to tap into your savings, you want to be well-prepared to replenish your emergency fund. Good luck!

If you’d like to discuss your emergency fund options with us, book a call using this link and we’ll be in contact with you shortly.

The idea of retiring in your 50’s as opposed to your 60’s appeals to many Americans, and for good reason. Why postpone the good life, right? However, if you are serious about retiring early, you need to plan in advance and make sacrifices many years ahead of time.

Here are 8 areas to consider if your serious about retiring in your 50’s:

1. Free Time

Many folks welcome any free time they can get, yet don’t consider how to manage it once they retire. It’s important not to dismiss the notion of being bored in retirement. Think about your social circle (spouse, friends, colleagues, etc.) who may still be in the workforce. Your schedules could potentially look very different once you retire, leaving you with a lot of free time you may not be used to.

Before retiring, think about things you’d like to do on your own – volunteer in the community, hike local trails, try a new workout class, etc. Ideally these new activities won’t cost you a lot of money, and might even give you the chance to earn some “fun money”. Consider the costs involved with how you spend your new free time, but most importantly, make sure these new activities give you purpose when you wake up in the morning. This is your chance to get creative, so have fun with it!

2. Debt

Becoming debt free should be a priority at any stage in life, especially if you want to retire in your 50’s. If you’re aiming to retire early, rid yourself of any consumer debt like credit cards and auto loans. Of course, paying off your mortgage is a major plus, but it may not be realistic for everyone. Regardless if you own or rent, prioritize keeping your housing related expenses manageable that way you increase your cash flow. By eliminating debt service payments (expense), you will fund your retirement accounts (income). If you’re serious about retiring in your 50’s, get aggressive about eliminating consumer debt.

3. Expenses

Retirement expenses are directly tied to your debt and how you spend your time. As you begin to plan for retirement, it’s important to be transparent when it comes to your expenses. All too often people don’t take an honest account of how much discretionary spending they do – eating out, entertainment, travel, etc. – and it throws off their projected retirement expenses.

You can safely expect to spend an extra 10% – 15% over your planned budget for the first couple years of retirement. This gets you ahead of the game and provides a buffer if you need it. The last thing you want to do is retire, only to come to the realization that you’ve significantly miscalculated your discretionary budget. It’s better to be upfront and honest about your spending habits before retirement than have to adjust later once you’re retired.

4. Cash Reserves

The need for adequate cash reserves is never more important then it is in retirement. Life is always throwing curve balls our way and that does not change in retirement. In my experience, the better you prepare, the less likely emergencies strike. Beef up your cash position and plan for any large purchases. A general rule of thumb is 3 to 6 months of expenses, but in retirement I would certainly lean toward 6 months.

If you have trouble saving up your emergency fund, consider setting up an allotment from your paycheck to a bank separate from where you have your primary checking account. Out of sight out of mind. Last minute weekend getaway or new patio furniture: not an emergency. Roof fails or air conditioning unit dies in July: emergency.

5. Retirement Savings

Most Americans have a large portion of their money in retirement accounts – 401(k)s, IRAs, 403(b)s, TSPs, 457, etc. These accounts are ideal for retirement savings due to tax benefits. However, keep in mind most employer-sponsored retirement plans have early withdrawal penalties prior to age 55. IRAs and Roth IRAs have penalties for withdrawals prior to age 59.5.

As you approach retirement, do your research on different retirement account options. There’s a 72(t) early withdrawal provision that allows substantially equal periodic payments from a retirement account as long as the distributions last until age 59.5 or 5 years, whichever is longer. You can also fund a non-retirement brokerage account early and often. These types of accounts allow you to investment in the same way you can in retirement accounts without early withdrawal penalties. Explore the pros and cons of each, it’s best to know all your options.

6. Social Security

The earliest you can start collecting Social Security is age 62, so there’s really no need to factor it in. However, if you are planning on earning income in retirement, you’ll want to be aware of the social security earnings test. In 2018, Social Security will withhold $1 in benefits for every $2 of earnings in excess of $17,040. This applies in years before the year of attaining NRA (Normal Retirement Age).

If you are in your 30’s or early 40’s, you may not want to factor Social Security income into your retirement plan at all. Not because you won’t receive Social Security (although a lot can change in 15-25 years), but it’s always better to be over-prepared than under-prepared.

7. Withdrawal Rates

If you’re planning to take income from your investment portfolio when you retire, you’ll want to be sure you’re taking it at a sustainable withdrawal rate. The money will need to last you 30, possibly 40+ years. If you are starting income distributions from your investment portfolio in your 50’s, you’ll want to avoid anything higher than a 3% – 4% withdrawal. Play around with the numbers to make sure your withdrawal rate is sustainable for retiring in your 50’s. The last thing you want to do is outlive your money.

8. Health Insurance

Medicare starts at age 65, so if your employer does not offer you the ability to continue health benefits into retirement, you’ll need to factor in the cost of increased health care costs between retirement and age 65. Do your research and plan on the costs increasing between now and retirement. If you have a spouse and they have coverage through their employer, consider switching to their policy.

Be sure to periodically reassess your goals. You may have set a goal years ago that has lost its luster today. If you always had the goal of retiring in your 50’s, for example, but find fulfillment in your work, don’t hold yourself to a goal you made years ago. I’ve seen folks retire because they’ve romanticized the idea of retirement for so long, only to end up regretting the decision. It’s okay if your goals change, just make sure they align with the season of life you’re in.

Retiring in your 50’s is absolutely doable, but requires planning and smart changes to your personal finances now. As a part of the workforce, you’re trading your time for money. However, once you retire, this is no longer necessary to meet your lifestyle. That doesn’t mean you shouldn’t work or do income-producing activities. In fact, if you can have fun, meet new people, or follow a passion while generating income, that’s an added bonus. However, if after running the numbers you know you’ll have to work in retirement, take a step back and reevaluate your situation. It might be a good idea to get an unbiased opinion from a financial planner to look at your situation.

If you’d like to discuss your options with us, book a call using this link and we’ll be in contact with you shortly.

It’s no secret that college expenses add up quickly. Nowadays, paying for college takes time and careful consideration of a family’s finances. Good news is there are plenty of saving plans available to help pay for college – the most popular one being the 529 Plan. The biggest appeal of the 529 Plan is it offers tax free growth when used to fund qualified higher education and high annual contribution limits. However, there are a few scenarios (one in particular) where a Traditional or Roth IRA may be a viable option to consider.

The most common scenario occurs when there hasn’t been any money set aside for your child approaching college – not in the budget, simply overlooked, unsure of a college savings account benefits, or any number of other reasons – but you have an IRA or Roth IRA account and you feel it’s important to help your child pay for their college education.

In this case, there is an exception that allows IRA distributions for qualified higher education expenses like tuition, books, supplies, fees and room and board, etc. as long as the student is enrolled in a degree program. This exception allows you to avoid the 10% early withdrawal penalty on IRA distributions if you are under the age of 59.5. If you are older than 59.5, this exception does not apply to you as there no penalties to withdraw from your IRAs at that age.

Balances in IRAs and Roth IRAs are not used for financial aid need analysis purposes and should not affect financial aid eligibility. However, withdrawals from IRAs are generally treated as income and may affect eligibility. Even withdrawals from Roth IRAs are treated as untaxed income and may affect needs based financial aid eligibility the year following the withdrawal.

So basically you have a traditional IRA being used as a tax-deferred college savings vehicle. If you are able to limit your withdrawals from a Roth IRA to contributions only, the distribution is not only tax free, but penalty free as well when used for qualified higher education expenses.

I want to emphasize that prior to considering this option, it is absolutely imperative you thoroughly review your finances to make sure this will not put your financial future and retirement plans at risk. I’m not an advocate of borrowing or withdrawing from retirement accounts for any reason outside of providing for life in retirement, and I strongly advise against placing your financial future in jeopardy to fund your child’s college education. I have seen this happen far too often with very poor outcomes – becoming a financial burden to the kids later on, pushing back retirement or worse, not being able to retire at all. I have also seen folks withdraw significant portions of their IRAs to fund their kid’s college, only to see them drop out.

To be clear, I am not suggesting student loans. However, the fact is students can borrow money for college and there are no retirement loans available, as far as I know. If your child needs to take out a loan, by all means consider helping them pay off their student loans once completing their education. Whatever you decide to do, make sure you prioritize evaluating the long term effects this will have not only on your finances, but theirs as well.

Other important considerations include:

- Distribution and expenses must happen in the same years

- Qualified educational expenses can only be used towards one educational tax benefit (no double dipping!) Ex: you can’t take a penalty-free IRA withdrawal and use the same expense toward a Lifetime learning tax credit.

- You can’t replenish the funds you withdrew from your IRA account except by normal annual contributions, which are subject to annual limits

If you’d like to discuss your options, book a call using this link and we’ll be in contact with you shortly.

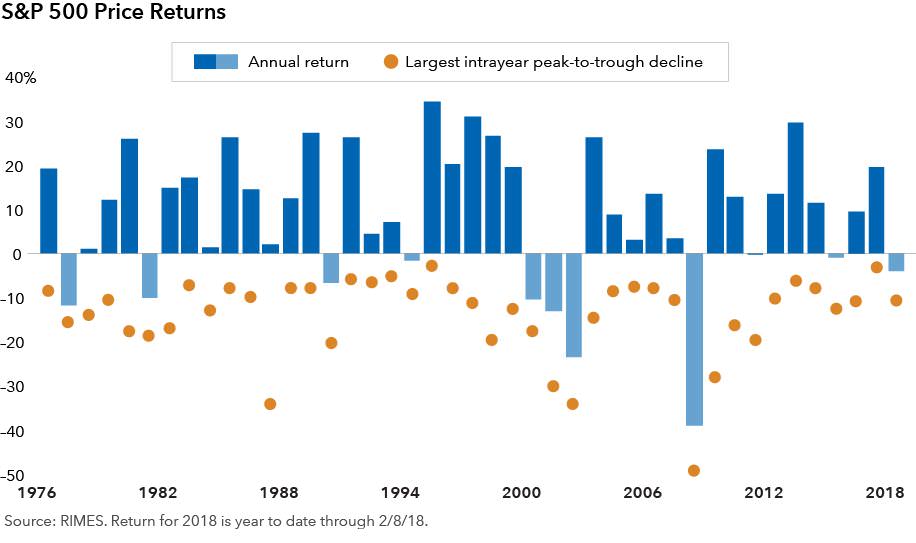

By all accounts it has been a phenomenal run for stocks. Through the end of 2017, the S&P 500 has had a positive total return in 19 of the last 20 quarters. The S&P 500 recorded a loss of 0.8% in the first quarter of 2018. This is the ninth time since 1990 that the stock market was negative during the first three months of the year. The S&P 500 went on to record a positive return for the entire year in five of the previous eight years that started with a loss (1992, 1994, 2003, 2005 and 2009) and suffered full-year of losses in the other three years (1990, 2001 and 2008).

It’s also clear that market volatility is back in 2018 versus the remarkably low volatility we experienced in 2017. To put things into perspective, the S&P 500 in 2017 had a total of nine 1% gain or loss trading days. In the first quarter of 2018 alone, the S&P 500 has had more than 20 1% gain or loss trading days. Given the uptick in volatility and panic inducing, sensationalized media coverage, I would like to provide you with three tips to help you stay focused on your long term goals and avoid undue stress that can accompany short term declines in the market.

1. Tune out the news and don’t act on emotion

In case you didn’t know, the news media outlets may not have your financial interest in mind. Their goal sometimes is to keep you in fear and tuned in for better ratings. Market pull backs are normal and should be expected in exchange for the opportunity of achieving long term growth.

As demonstrated by Nobel Prize-winning psychologist, Daniel Kahneman, loss-aversion theory says that people feel the pain of losing money more than they enjoy gains. Naturally, investors flee the market during sudden, sharp declines and in the same way, greed motivates them to jump back in when stocks are on the rise. Both of these natural impulses can be devastating to your long term goals, but investments rooted in proper education, unbiased research and proven strategies can overcome the impulse and pull of emotion.

Below is a chart showing intra-year declines (orange dot) of the S&P 500 as well as annual year end returns (blue bar):

2. Change your investments proactively, not during market declines

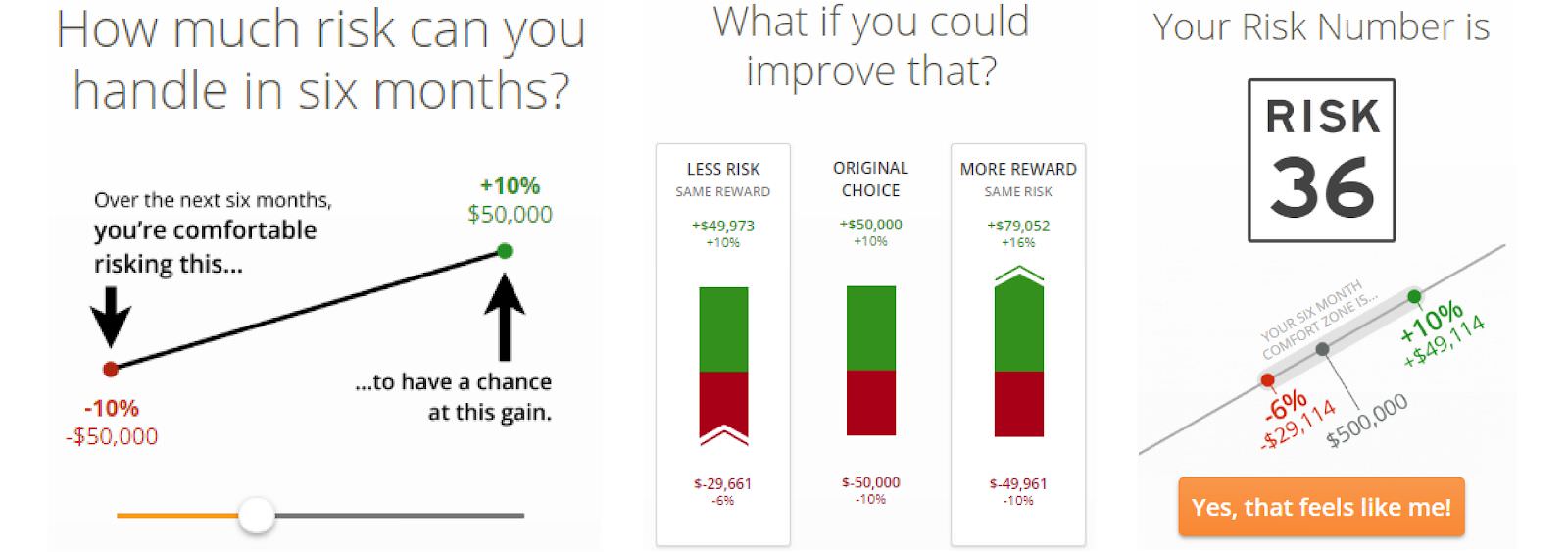

Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

Ideally, you have taken the time to properly assess your risk tolerance and aligned your investments (as shown above) with your ability to endure volatility. If done properly, the ups and downs in your portfolio shouldn’t cause you to have a knee jerk reaction at inopportune times. I recommend stress testing your portfolio to see how it may have performed in both good and bad years.

Below is an example of a stress test:

Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

3. Be patient, your investments may thank you later

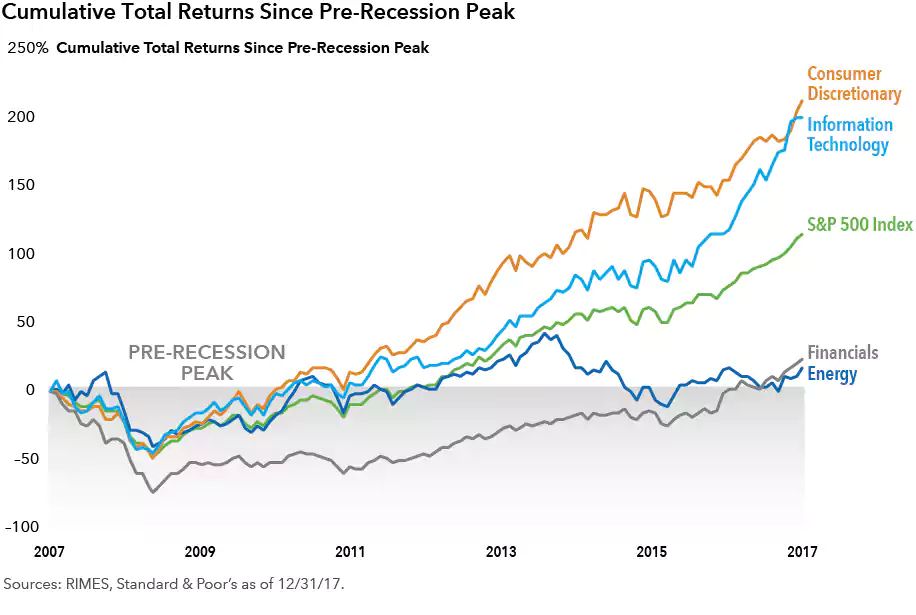

It is almost impossible for anyone to accurately predict short-term market moves, and investors who sit on the sidelines risk losing out on periods of meaningful price appreciation that may follow sharp market downturns. The visual below shows how allowing emotion and impatience to dictate your investment decisions can affect your long-term financial goals.

Many let emotion get the best of them during the 2008 and 2009 market downturn causing them to sell investments in their retirement accounts resulting in significant losses. Moreover, many did not reinvest for several years and missed out on several high growth years that followed.

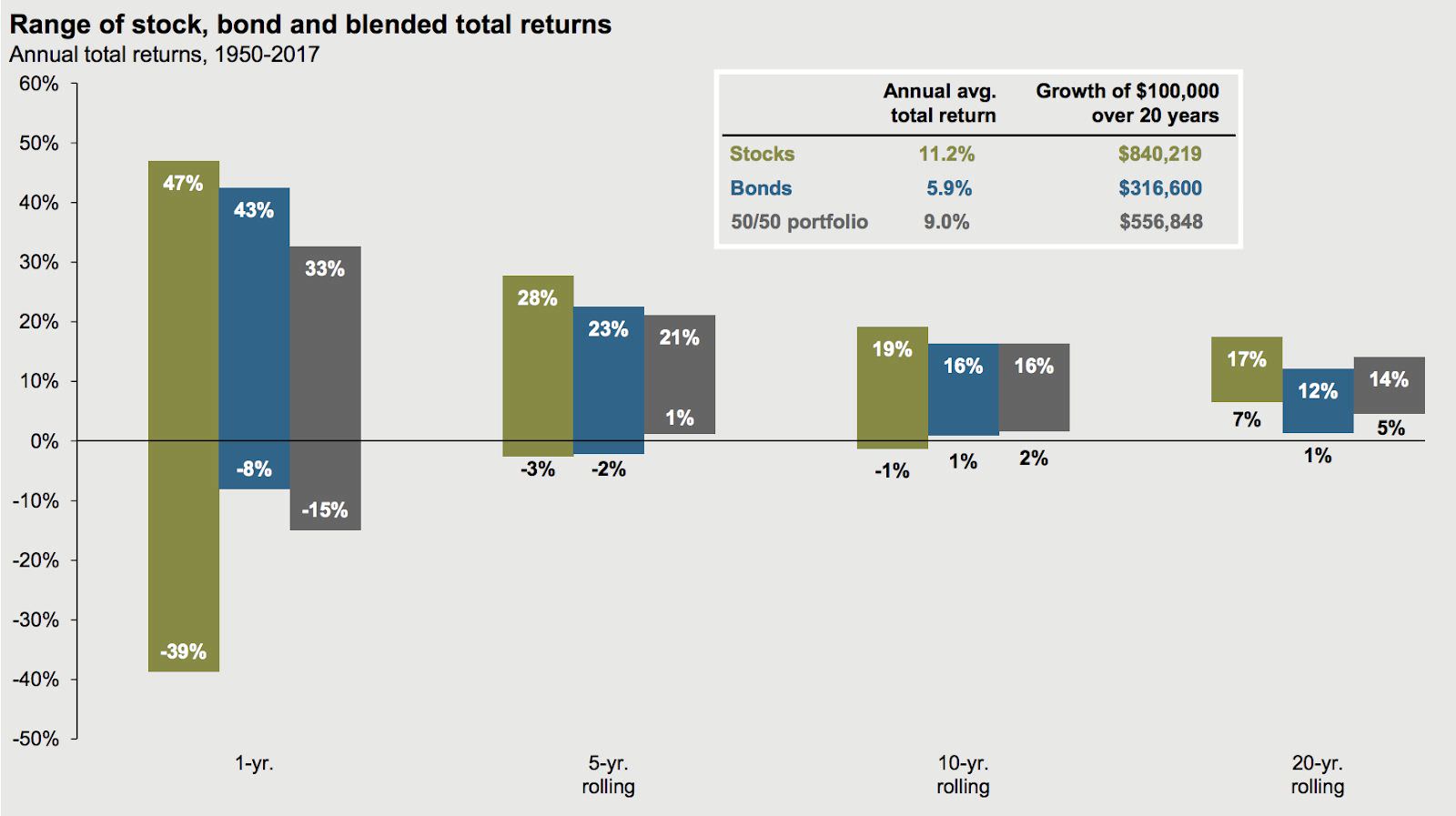

This chart clearly illustrates how patience pays. One year losses are common, however; a blend of stocks and bonds have not suffered a negative return in any five-year rolling period. This information does not imply that all future five-year rolling periods will mirror the past. However, understanding historical market data is a powerful tool to “fight the fear” that market volatility can bring about. Past performance does not guarantee future results.

Source: Barclays, Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are based on calendar year returns from 1950 to 2017. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Barclays Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2017. Guide to the Markets – U.S. Data are as of March 31, 2018. Past performance doesn’t guarantee future results. Examples are for illustrative purposes only. Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation. Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

The Overview

The U.S. Senate recently passed a new tax bill titled, “Tax Cuts and Job Act”. President Donald Trump signed this bill, stating that it will be beneficial both to individuals and corporations. The bill will go into effect for 2018 taxes, bypassing 2017 taxes.

The Breakdown

The bill has a wide range effect, impacting all taxpayers to a varying degree. As always, your income will significantly impact your taxes – those in higher tax brackets will feel a bigger impact. However, there are many tax brackets that are lowering.

Analysts have noted that the standard deduction will nearly double for many households, which means many will opt to take that rather than itemize their taxes in the coming years. In addition, the child tax credit for each child under the age of 17 has significantly increased from $1,000 to $1,600 per child. It’s also important to note that the personal tax exemption has been eliminated under this new tax bill, which could be a setback for some households.

The Implications

If you’re anything like me, hearing the news of a new Senate Tax Bill brought one question to mind, “What does this mean for me, specifically?”

The Balance explains the bill well,

“The Act keeps the seven income tax brackets but lowers tax rates. Employees will see changes reflected in their withholding in their February 2018 paychecks. These rates revert to the 2017 rates in 2026.

The Act creates the following chart. The income levels will rise each year with inflation. But they will rise more slowly than in the past because the Act uses the chained consumer pride index. Over time, that will move more people into higher tax brackets.”

The article goes on to explain,

“The Act lowers the maximum corporate tax rate from 35 percent to 21 percent, the lowest since 1939. The United States has one of the highest rates in the world. But most corporations don’t pay the top rate. On average, the effective rate is 18 percent.”

Hopefully this helps you get a sense of how you’ll directly be affected. Please feel free to contact us if you’d like to further discuss the bill and how it specifically affects you.

Save Now, Then Save Some More!

We all know that saving for retirement is important, and it’s never too early to start. However, it never feels as simple as putting money aside – there’s always something that gets in the way. Whether it’s loans or debt that’s holding you back, is it better to pay off what you owe first or prioritize saving for your retirement account?

The Million Dollar Question

Building your retirement savings account is critical, but at what cost? Most of us enter the working world with some level of student loan, not to mention the possibility of developing more down the road – car loans, credit card debt, etc. – yet we’re being told to start saving for our retirement as soon as possible.

So how do you balance paying off owed money and simultaneously save for the future?

The Balance

As a financial advisor, I’m a strong advocate for saving for retirement as much as you can as fast as you can. That being said, I firmly believe the priority is to pay off your debt first, particularly the ones with high interest rate.

If you have high interest debt, then the amount you’re losing in interest each month may be more than what you could be earning in compound interest in savings.

I often tell my clients that once they’ve paid off high interest rate debt, then they can start contributing to their retirement savings account. This, of course, will look different case by case, but never rule out saving for retirement just because you owe money! Prioritize paying off your debt now as a way of being proactive about your future. The better you plan, the better you retire – and therein lies the balance.

Don’t Take My Word for It

Forbes weighed in on this topic as well,

“While this question is best put to a financial planner who can look at your entire financial picture, one way to think of it is that, if your student loan interest rate is 6.8%, the payments you make toward those loans give you a guaranteed 6.8% return on your money. Your retirement investments, especially after accounting for inflation, may not do as well. On the other hand, if you’re 50 and are behind on saving for retirement, you’ll still want to get the ball rolling since time is the biggest factor in how much your investments can grow. Bera says that for any debts with interest rates above 6%, she favors paying down debt over saving for retirement, but once you eliminate all those and are left with debts with lower interest rates, the emphasis would swing back to retirement.”

Low interest debt that’s tax deductible, like a mortgage, doesn’t need to be paid off before saving for retirement. However; I recommend you pay off all other high interest debt first, and then you can begin contributing the maximum to your retirement savings account.

If you’d like personalized advice on how much you should be paying/saving, one of our advisors will be happy to sit down with you and strategize how to get you on track for your best retirement.

Please schedule a call with us here if you would like to discuss your options.

Big News from the IRS

After two years without any changes, the IRS announced they will be increasing the 401(k) contribution limits for 2018. This is exciting news!

The increase in cost of living will allow individuals to contribute up to $18,500 ($500 increase) per year to their 401(k) retirement plan. Additionally, this increase will apply to other retirement accounts including 403(b) plans, most 457 plans, and Thrift Savings Plans (TSPs), however; the IRA and Roth IRA account contribution limits will not change. All employees should expect to see notifications from their employers about this increase.

Will This Really Make a Difference in the Long Run?

I always tell my clients that in order to grow their retirement savings significantly, they need to contribute as much as possible as young as possible. While an additional $500 per year may not sound like a major increase, ultimately these contributions will add up to a lot come retirement.

CNBC notes the significant difference of increasing your contribution to $500 each year, rather than simply putting an additional $500 in your savings account,

“As personal finance site NerdWallet points out, it could mean up to $70,000 more in your retirement account. The site calculated how much bigger your retirement fund would get if you started investing an additional $500 a year. It assumed a retirement age of 67 and a 6 percent annual rate of return. To give you an idea of just how powerful compound interest is, NerdWallet also highlighted how much money you’d have if you didn’t invest the $500 a year and simply kept it as cash:

- If a 30-year-old starts investing an extra $500 a year, it could mean an extra $70,212 in retirement, versus $18,500 saved in cash.

- If a 40-year-old starts investing an extra $500 a year, it could mean an extra $34,712 in retirement, versus $13,500 in cash.

- If a 50-year-old starts investing an extra $500 a year, it could mean an extra $15,202 in retirement, versus $8,500 in cash.”

How the Increase Positively Impacts Your Taxes

In addition to increasing your retirement savings, your taxable income will also be reduced when you contribute the additional $500.

If you have an employee contribution matching plan, a good rule of thumb is to contribute the maximum matching amount so you take full advantage and not leave any money on the table. However, if you can contribute more and maximize your 401(k) contributions each year (coupled with compounding interest), you’ll have a much larger retirement savings account.

Schedule a free call with us today if you have any questions regarding the increase in 401(k) contribution limits for 2018.