how we help

Your future deserves more than numbers on a page. That’s why we bring every element of planning, investing, and wealth management together to help you live with confidence and clarity.

Live Fully, With Purpose

Turn Savings Into Experiences

Align Money With Purpose

your retirement benefits

explore investment management in scottsdale

We're here to help guide you through every step of your retirement journey, including:

Personalized financial planning

Intentional investment management

Strategic income & benefits alignment

achievements

Ranked Among Arizona’s Top 10 Independent Investment Advisors

Families Guided Toward Confident, Purposeful Retirements

Helping You Build the Future You Love

services

start building towards your dream retirement

Enjoy the retirement you’ve worked hard for. Whether you’re preparing for the years ahead or already retired, we’re here to help you make the most of your benefits and confidently embrace your next chapter.

plan & invest

Take control of your financial life with a purpose-driven plan that transforms your wealth into freedom, experiences, and lasting memories—helping you live fully today and confidently prepare for tomorrow.

government employees

Retirement planning shouldn’t feel daunting—learn how to maximize your federal benefits, avoid costly mistakes, and confidently prepare for the retirement lifestyle you’ve worked hard to earn.

business owners

We help business owners balance today’s demands with tomorrow’s goals. From reducing taxes to building wealth, preserve what matters most so you can have lasting freedom and fulfillment.

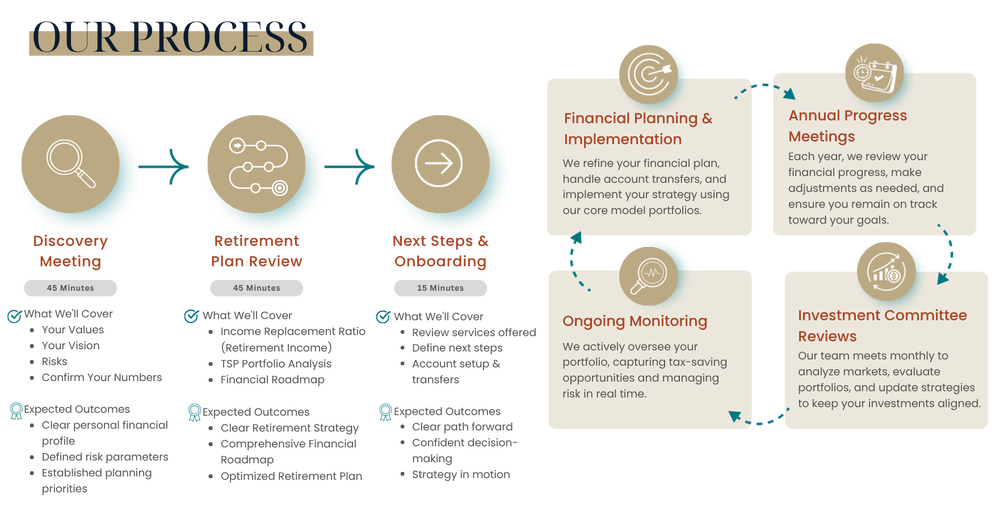

a personalized process

financial planners helping you feel confident in your financial future

We start by understanding what matters most to you — then create a personalized strategy to help you live intentionally and confidently. From growing wealth and protecting what you value most to creating lasting memory dividends through experiences and freedom, our advisors design a clear, actionable roadmap for your success.

fee structure

We provide exceptional service and proactive guidance—helping those with $500,000+ in retirement savings turn their wealth into confidence, freedom, and lasting experiences.

Account Minimum: $500,000

Management Fee:

• 1.50% = First $499,999

• 1.25% = $500,000 – $999,999

• 1.00% = $1,000,000 – $2,999,999

• 0.75% = $3,000,000 – $4,999,999

• 0.50% = $5,000,000+

personalized investment management

Our job is to help grow and preserve your wealth. We start by understanding you — your goals, values, and reasons for investing — then make recommendations tailored to you and your vision for the future.

you're a few steps away

take control of your future

Schedule a 1-on-1 Consultation

Fill out our inquiry form to schedule a $350 discovery meeting with our team (Complimentary consultations available for those within 36 months of their retirement date). We will share a list of required documents prior to meeting to ensure you get the most out of your consultation.

Discuss Your Retirement Goals

In this initial consultation we will conduct an in-depth discussion of your financial history, current situation, and future goals. Key topics covered during your discovery meeting include retirement, cash flow analysis, investments, taxes, insurance, estate planning, financial milestones, life events, and more.

Get a Personalized Retirement Plan

Join us for a second meeting where our team will present a detailed plan tailored to your goals, with actionable steps on how to prepare for retirement.